Acquisition Finance

It’s monday and it’s time to move on from the MBA Mondays series on Employee Equity. We did nine posts on employee equity and hopefully we moved the needle a bit on understanding that complicated topic.

I’d like to switch topics now and talk about acquisition finance. The other day Chris Dixon said this in a comment here at AVC:

the two biggest tech companies alone (apple and google) are approaching $100B in cash that they will likely use for acquisition to support their incredibly profitable businesses

The point Chris was making with that comment is there is a lot of buying power out there in the big tech companies that can be spent to buy tech startups. And he is right about that. Google has $34bn in cash. Apple has $50bn in cash and short term investments. Microsoft has $44bn in cash and short term investments. eBay and Amazon each have more than $5bn. The numbers add up to a lot of buying power out there.

But just because they have the cash doesn’t mean they will use it. There are a number of factors that acquirers consider before pulling the trigger on an acquisition. They look at whether the acquisition will improve or hurt earnings going forward. They look at how they will have to book the acquisition on their balance sheet. They look at how dilutive the acquisition will be to shareholders (even if it is a cash acquisition, they may need to issue employee equity for retention). And most of all, they attempt to determine how the acquisition will be recieved by their shareholders and what impact it will have on their stock price.

I am calling this entire topic acquisition finance. I am not an expert on this topic but I’ve got a working knowledge of it and I am going to share that working knowledge with all of you over the coming weeks.

From the comments

chris dixon added:

Great topic. Looking forward to future posts. One thing I would mention is I think most big companies think about acquisitions either from a product of financial perspective. Product acquisitions are usually championed by high ranking product lead and financial metrics are far less important. Usually these are sub $100M. Financial acquisitions are led by M&A group, who are basically just given the mandate: “wall street is pricing us to grow 40%, but we are only growing 20% organically, so I need to acquire things that get our growth % closer to 40.” This is how you explain otherwise head scratcher acquisitions like Intel buying McAfee. In my experience each type of acquisition has a very different process and should therefore be discussed separately. (Although of course in real life these distinctions sometimes get blurred, especially when CEO is product person like Jobs or Bezos).

To which fredwilson quipped:

maybe companies should pay more for product acquisitions and not make financial ones

And chris dixon agreed:

I agree. Financial acquisitions are an artifact of short-term public market thinking. CEO wants to show growth next few quarters and run a bigger empire. Bankers and sellers all make money on transaction. Market likes it because it shows growth and justifies high P/E (versus, say, dividending cash out which would signal the non-growth stock).

This distinction is quite real – I’ve observed it first hand many times from inside bigcos.

Separately, Nikhil Nirmel brought this up:

On my plane ride back from Thanksgiving, I sat next to a guy who works at Apple and is very familiar with Apple’s acquisitions process. I asked him how Apple makes acquisition decisions. He said the initial word of eventual acquirees typically comes from the engineers – they hear about an interesting team or technology, Apple talks to them about potentially working together, and then sometimes they’ll try to acquire them. He said that Apple gets pitched a lot by companies that are trying to get acquired and that strategy very rarely ends up in an acquisition. Finally, he said that the tide is turning for Apple – whereas Steve used hold the belief that acquisitions were unnecessary for Apple because they have the best team internally, now they’re realizing that it can make sense to acquire small teams who have a technology built that would save Apple time by not having to develop entirely internally.

To which fredwilson replied:

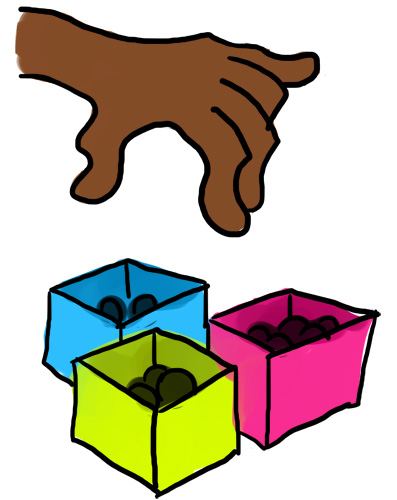

startups rarely get sold

they are almost always bought

This article was originally written by Fred Wilson on November 29, 2010 here.