M&A Issues: Timing

Yet another post in the M&A Issues series. This one is about timing, ie how long it should take from the first serious conversation about a sale transaction until the closing.

I’ve seen acquisitions done in a week. I’ve seen acquisitions take over a year from the first serious conversation to close. And one thing I know for sure, if a buyer wants to take their time and feels like they can get away with it, they will.

Not every buyer wants to take their time. Many buyers want the transaction closed as soon as possible. In that case, the seller has alignment with the buyer and the transaction closes quickly.

Sellers usually want a quick close. They should. Selling your business is distracting and fraught with risk. One you decide you are going to sell, you should move with as much speed as you can while being diligent, thorough, and reasonable.

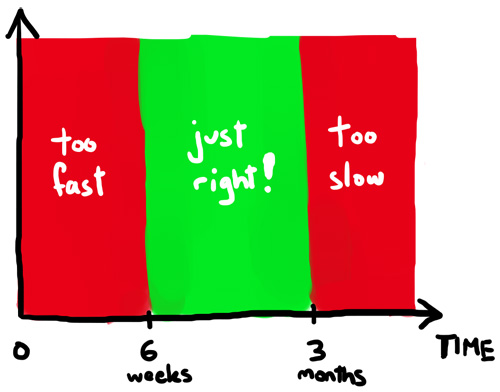

Six weeks from serious conversation to close is fast. If the company is “clean” and the buyer is incented to do a quick close and there are no governmental approves, it can be done.

Anything over three months is too long. The sale process starts to hang over the company and impacts the team, the business, and can lead to lasting problems. Team members get antsy. Resumes hit the street. Customers hear rumors and start thinking about plan B. The senior team loses focus. The company suffers.

If there are reasons why a close is going to take a long time (governmental approvals, buyer approvals, diligence, etc) an approach you can take is to sign a defintive agreement which obligates both sides to close and provides remedies if the close does not happen (including breakup fees). This is often the way deals are done with public companies that require shareholder approval.

Another key issue related to timing is the news leaking out. The longer the process goes on, the more likely the news will leak out. The reality is most deals leak and it rarely gets in the way of a deal getting done. Buyers hate it when the news leaks out because it can bring additional buyers into the process and make it more competitive. But most sellers should prefer a quiet process too. The less chatter about the sale, the better in my opinion.

I’m a fan of quick M&A processes, within reason. It takes time to do the required diligence and legal work. Doing a deal in a day is generally not a good idea. Doing it in six weeks is desirable and should be the goal. Anything longer than three months is likely to be problematic and will require a ton of management effort to manage the fallout. If you are a seller, you should specifiy the time to closing in the LOI and do everything in your power to make the buyer meet that deadline. And if you are buyer, you should respect the seller’s desire for a quick close and work hard to make it happen on your end.

From the comments

JLM added:

Like most everything in business, selling a company is a talent which can be developed and perfected. It requires a bit of focus and diligence and really not much more than just a dash of luck. Of course, the harder you work, the luckier you become.

The two best answers to anything in business are a quick yes or a quick no. Even getting a quick no is better than a long drawn out unfruitful courtship.

The most important thing to learn is the motivations of the prospective buyer. If a buyer cannot articulate why the buy makes sense — then they are just fishing.

Find out whether the buyer is an experience buyer both personally and in that business entity. A company may have never bought anything but if the principals are deal guys, they are still deal guys. Everybody’s first trip to the rodeo takes longer to absorb the process.

Figure out immediately if they have the money. No money coupled with a handful of Viagra still doesn’t get you any deal wood.

Then I would counsel to do all the heavy lifting yourself and be prepared to do it at night after you have worked all day — letter of intent, contract, due diligence, closing checklist and closing. Force it not to impact your business.

Take a lot of early morning breakfasts to deal with the other guys and make them deal face to face. You can read when the deal wood has gone soft if you meet face to face.

Make the buyer put up a meaningful amount of earnest money. This is a test of commitment. Recently I had some guys fling a contract over the transom and it had $5K in earnest money — probably an approximation of their Am Ex account for a weekend. I countered with 5% of the deal and they bit — surprised the hell out of me. Deal did not make but I got a quick “no” in the next three days.

Competition — create it, if you can. Don’t shop the deal if you have a “no shop” provision but get over that hurdle right up front.

Ask the buyer if they are pragmatically capable of keeping your deal confidential and then make confidentiality a default condition and if the deal gets out, then have the right to pull the plug and keep the earnest money. It is not a great resolution but it keeps folks honest.

This article was originally written by Fred Wilson on March 14, 2011 here.