Sizing Option Pools In Connection With Financings

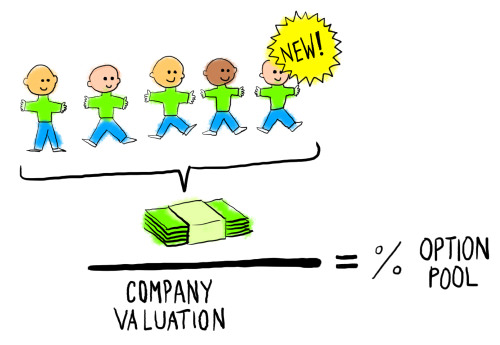

We’ve talked about this issue before here at AVC. Investors like to require that an unissued option pool is in the pre-money valuation calculation when they put money into early stage companies. If you don’t entirely understand what I am talking about here, go click on that link at the start of the post. Hopefully it will explain the issue.

This post is about how to size the option pool. Many investors just want the number to be as big as possible. They’ll put 15% into the term sheet and then let the entrepreneur negotiate them down from there and maybe if you are lucky you’ll get them to 10%. But there is no logic in that kind of negotiation. It is just a price negotiation disguised as something else. It is bullshit. And I see investors engage in that kind of practice all the time. It annoys me.

What I like to do, as I mentioned in the post I linked to, is agree with the entrepreneur that the option pool will have enough unissued options to fund all the hiring and retention grants that need to happen between the current financing and the next one. Then we’ll do the same thing at the time of the next financing. That makes sense to me. And it is pretty easy to do.

Let’s say you are raising $1mm at $4mm pre-money. And the investors want the option pool to be in the pre-money valuation. Let’s say the $1mm will last you 18 months. Then you determine how many people you are going to hire in the next 18 months. If the financing is $1mm, it’s not going to be that many. You probably have three to five employees already. Without revenue coming in, five employees will suck up half of that money over 12 to 18 months. So at most you are going to hire another 5 employees.

Here’s a formula I like to use. Take the cumulative salaries of all the hires you need to make betwen the current financing and the next one. Let’s say it is five employees at an average of $75,000. Then that number is $375,000. Then divide that number by the post-money valuation, in this case $5mm. That gives you 7.5%. That’s the size of the option pool you’ll need. And it is conservative because I don’t recommend giving options equal to the dollar value of the annual salary of your hires. I like anywhere between 0.1x to 1x (depending on role and responsibility), with the average being in the .25x range. But early on in a company, you will need to and want to be more generous.

This approach assumes you have already granted employye equity to the existing team. Ideally they will have founders stock or restricted stock. But whatever they have, they should be holding sufficient equity to keep them happy and excited to be working in your startup. If that isn’t true, you will need to add some additional equity to the pool to take care of them.

The bottom line is that sizing up option pools should not be like horse trading. It should be a science. It should be based on an option grant methodology that is driven off annual salary, and an option budget based on headcount and hiring plans. And if you do it that way, you will end up with a lot less dilution. Which is what you should always be trying to achieve.

From the comments

Mav asked:

what is the logic of carving out option pool from pre-money vis-a-vis post-money? IMHO, post money seems more fair to me as future employees add incremental value to post money situation. Also, post money conveys that VC and entreprenuer are in it together. I’m sure that there is a reason for carving out option pool from pre-money as Fred seems to be totally for it, can someone explain?

To which fredwilson replied:

it’s just convention

this is all about valuation at the end of the day

you could include the option pool in the post money and simply agree to a

lower valuationit’s like showing prices before or after tax

it’s just how it is done

This article was originally written by Fred Wilson on May 18, 2011 here.