Financing Options: Bridge Loans

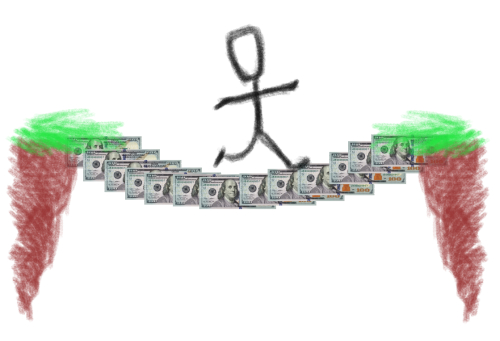

Today’s post in the financing options series on MBA Mondays is about Bridge Loans. Bridge loans are so called because they are a “bridge” to something else. They are short term loans intended to fund a company to an anticipated event in the future.

Bridge loans exist in many sectors outside of the startup world. Big banks will often bridge companies to transactions they are putting together for them. Real estate transactions are often bridged to a closing. The concept of short term transaction driven loans is universal in business.

In the startup world, bridge loans are a particularly interesting case to study. I’ve been in and around startups for 25 years now and I have rarely seen a bridge loan made by anyone other than an existing investor or investor group. Most bridge loans in the startup world are made to money losing companies that are going to run out of funds before they can close a financing or sale transaction. These are very risky loans that will not get paid back unless a transaction happens and often the transactions that are required don’t happen.

If you could assemble a data dump of all bridge loans made by VCs and angel investors to startups over the past twenty five years, I think you’d see that the aggregate performance of these bridge loans would be awful. I’m certain that the performance of bridge loans made by firms I’ve been associated with in that time is hugely negative. The loss rate is very high and the returns on the ones that work are not much better than a typical venture investment.

So why do VCs and angels make bridge loans when they perform so poorly? There are two reasons, and they are related but they are not the same. First, investors like to give the companies and teams they have backed a chance at success. Contrary to the popular view, VCs and angels are supportive of their portfolio companies well beyond what a hard nosed rational investor would be. I have seen startup investors make follow on investments many times that make no sense other than on a “doing the right thing” basis. Second, many investors are playing defense with these loans. They know they’ve made a weak or outright bad investment but they don’t want to acknowledge it with a writeoff, so they keep putting in good money after bad.

So bridge loans are often bad investments made defensively. And so they are red flags to other investors. When a new investor looks at a company and sees a bridge loan in place, they will understand that all is not well. This doesn’t mean you shouldn’t make or receive a bridge loan. It just means you will need to explain it. And it will make closing a financing more challenging.

Bridge loans made in anticipation of a sale are a bit different. There is a really strong rationale for making a bridge loan in anticipation of a sale. The investors know that a sale is coming so a priced equity round doesn’t make much sense. The company can’t sell equity cheap relative to what the expected sale price will be. And if the equity is priced close to the expected sale price, then there will not be an equity return when the sale closes. So a loan makes the most sense. And bridge loans are the best kinds of loans to do in this situation. An acquirer will not be terribly surprised to see a bridge loan in place when they look at the books and thus it is not nearly the same kind of red flag as it is in an equity financing.

When making a bridge loan, it is critical that the size of the loan be sufficient to get to the transaction you are bridging to. The bridge metaphor is a good one. You want the bridge to be long enough to cross the river. Otherwise it does no good. Getting a second bridge done is always very hard. So if you think you need three months to sell the company or get a fiancing done, get six months of burn in your bridge.

The biggest concern investors will have in making a bridge is the probability of a tranaction closing. Investors will not make a “bridge to nowhere.” So before you can realistically ask for a bridge, you must build a strong case for the transaction you want the investors to bridge to. Getting a banker or an advisor hired to help you secure the transaction you want is one good way to give investors comfort in making a bridge. It doesn’t guarantee that you will get a deal done, but it shows everyone that you are committed to making it happen.

The terms of bridge loans are pretty standard. The loan will be secured by all the assets of the business that can be pledged. If there is existing bank debt or equipment financing, the bridge will be subordinate to those loans. And you will need the bank’s cooperation getting a bridge done if there is a bank involved. Sometimes that is not easy.

The loan will carry an interest rate of between 6% and 12% depending on the current rate environment and will have warrant coverage or a discount. We covered the concepts of warrant coverage and discounts in the convertible debt post earlier in this series. Bridge loans are a specialized form of convertible debt.

In summary, bridge loans are common in all businesses. In the startup world they are often a sign of distress and for that reason you should try to avoid them if you can. But when you are sinking, any lifeline looks good and bridge loans are no different. Beggars can’t be choosers. In a sale process, bridge loans are less problematic and are often the right solution to financing a company to a sale transaction. For startup investors, bridge loans in the aggregate are a poor performing investment and as an industry, we dislike making them. But like all of the tools at our disposal in the statup world, bridge loans are a reality of our lives, we will all experience them from time to time, and they can be a useful form of financing at a critical time in the life of a company.

From the comments

Dan Cornish added:

For any CEO considering a bridge loan understand that the terms of control by your investors you were funded under go away to the terms of the bridge loan. Remember, you are out of money, you need a lifeline, but your lenders can call the loan and let you drown. The lenders can force a change of control or recap the company to crush out existing shareholders, or many other bad things. A bridge loan is a last resort or the way I think of it a last gamble. Never run out of money is the first second and third rule of a CEO.

This article was originally written by Fred Wilson on August 15, 2011 here.