MBA Mondays: Cap Tables

Cap Tables (short for capitalization tables) are spreadsheets that show how much everyone owns of the company. You can get a stockholder ledger from your lawyer that will list all the stockholders and show how many shares or options they have, but I don’t consider that a cap table.

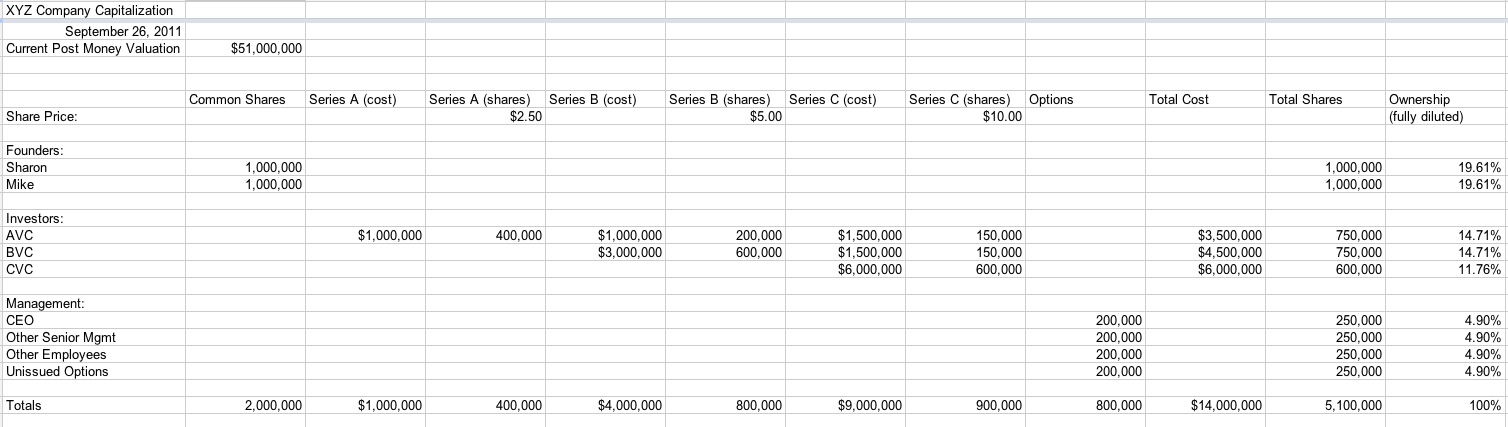

For the past 25 years, I’ve used a simple form, mostly given to me by the partners I worked for when I first entered the venture capital business in the mid-80s, but with a few modifications by me over the years. It looks like this (click on the image to enlarge):

Last night I put together a public read-only google spreadsheet that shows you a basic cap table in the format I like to use. You can check it out here.

The basic outlines of this cap table are:

- it shows all the major stockholders of the company listed down the left side. it also shows the major option holders and buckets of option holders

- it shows all of the classes of stock and how much was paid for them across the top of the columns

- for each investor, you show how much of each class was bought and how many shares of that class they own as a result

- you total up the cost and shares and then calculate ownerships on a fully-diluted basis (which means you include the options, whether issued or non-issued or vested or non-vested).

I like this presentation for its simplicity and because it shows the progression of financing activity. It also has the benefit of showing how much each investor has put in on a cost basis, which many cap tables leave out.

If you want to make a cap table for your company, feel free to replicate this format. If you have angel investors, put them in the angel section. I would include the largest ones and bucket all the rest into “other angels.”

If you’ve got any questions about this cap table, or cap tables in general, feel free to ask them in the comments. I will answer them (maybe not until late today or tomorrow -I’ve got a crazy day today). And I bet the community will answer them too (probably well before me).

From the comments

JLM added:

Perfect, as usual.

I would add the option exercise cost (# of options X strike price) to total cost in order to square total cost w fully diluted ownership. Otherwise the total cost at full dilution is understated by this amount.

This article was originally written by Fred Wilson on September 26, 2011 here.